Ankit Nagori, the e-commerce veteran behind Flipkart’s early growth, spun off Curefoods from Curefit in 2020 to focus on cloud kitchens delivering nutritious meals. Now with over 500 locations across 70+ cities and FY25 revenue topping Rs 746 crore, the company is gearing up for a Rs 800 crore IPO, signaling the maturation of India’s online food sector where health and convenience drive a market expected to hit $20 billion by year-end.

Table of Contents

From Flipkart to Fitness: Ankit Nagori’s Entrepreneurial Path

Ankit Nagori, born in Bihar in October 1985, graduated from IIT Guwahati before diving into startups. In 2007, he launched Youthpad, a social media venture, and Simply Sport Foundation in 2020. His big break came as an early employee at Flipkart in 2010, rising to Chief Business Officer by 2016.

That year, Nagori co-founded Curefit with Myntra’s Mukesh Bansal, expanding into gyms, clinics, and food under brands like Cultfit and Eatfit. Seeking independence, he carved out the food arm as Curefoods in 2020, capitalizing on pandemic-driven delivery surges. “Behaviours and habits are like muscle building,” Nagori told Moneycontrol in 2022, linking his fitness ethos to business discipline.

Launching Curefoods: A Multi-Brand Cloud Kitchen Vision

Curefoods operates as a Thrasio-like incubator, acquiring and scaling small food brands with tech, capital, and supply chains. Starting with Eatfit for healthy meals, it now houses 10+ brands across cuisines, emphasizing low-calorie, sustainable options free from artificial additives.

The model blends cloud kitchens for delivery via Swiggy and Zomato (82% of FY25 revenue) with offline kiosks and restaurants. Nagori’s strategy targets diverse palates— from Sharief Bhai’s biryanis to Nomad Pizza’s wood-fired pies—while prioritizing nutrition. “We wanted to create products people could trust without compromise,” he echoed in broader wellness talks.

By FY22, operational revenue hit Rs 89 crore amid Rs 71 crore losses, per Business Today. Growth accelerated through acquisitions like CakeZone and Frozen Bottle, building a Rs 3,960 crore valuation.

Growth Milestones: Acquisitions, Funding, and Expansion

Curefoods raised $175 million over 16 rounds from Accel, Chiratae Ventures, and Three State Ventures (Binny Bansal’s fund), including $25 million in January 2024 and $6.6 million debt in March 2025. These fueled 502 service locations by FY25, up from 277 in FY23.

In December 2024, it acquired Krispy Kreme’s South and West India rights from Landmark Group, aiming for Rs 100 crore revenue in 2025. Plans include 75 cities by year-end, with UAE entry and 1,000 total sites (600 cloud kitchens, 350 QSRs) targeted soon.

Desserts led FY25 revenue at Rs 196 crore, followed by pizza (Rs 183 crore) and healthy meals (Rs 176 crore). Top brands like Sharief Bhai (Rs 148 crore) and Eatfit (Rs 145 crore) crossed Rs 100 crore ARR, with five now at that mark.

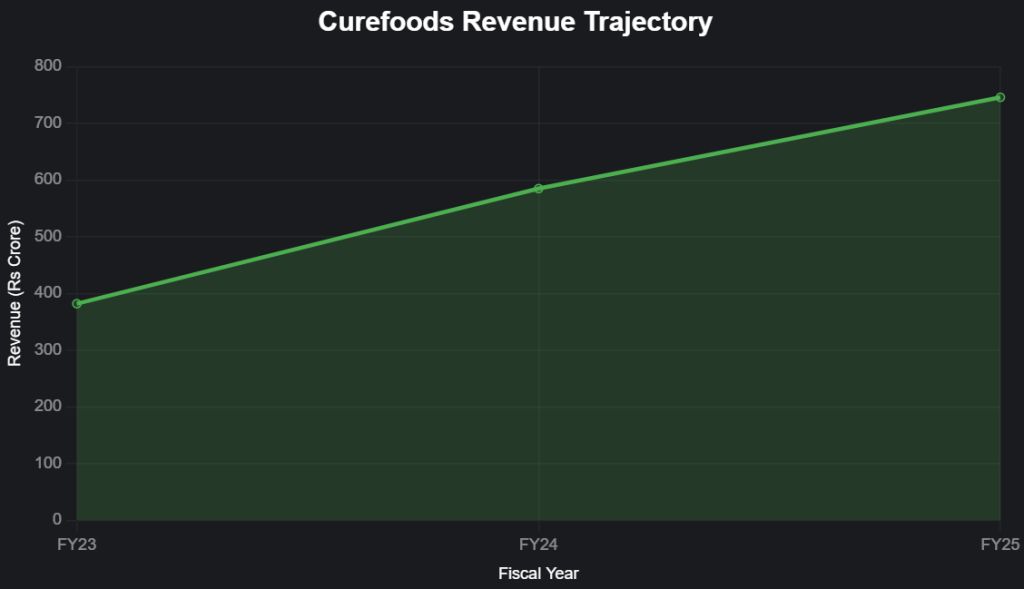

Curefoods Revenue Growth

Source: Company filings and reports from Entrackr, Moneycontrol, and Tracxn.

Financial Path and IPO Ambitions

Losses halved to Rs 172.6 crore in FY24 through ad cuts, staying flat at Rs 170 crore in FY25 despite expansion. ROCE improved to -19%, with EBITDA margin at -7.5%. Unit economics show Rs 1.27 spent per rupee earned.

In June 2025, Curefoods filed DRHP for a Rs 800 crore fresh issue plus Rs 485 crore OFS, eyeing Rs 152 crore for new kitchens and Rs 14 crore for marketing. Listing is slated for late FY26, valuing it at $451 million. “Our journey has only just begun,” Nagori posted on X in September 2025, marking five years.

Why Curefoods Matters

Curefoods addresses India’s health-conscious shift, offering sustainable, diverse meals in a $20 billion delivery market growing 15-20% annually. It supports small brands, creates 5,641 jobs, and cuts waste via efficient chains, per Nagori’s vision.

As competitors like Rebel Foods eye similar paths, Curefoods’ focus on profitability and Tier II+ cities sets a model for F&B startups. “Fresh funds will bolster our position as a leading house of brands,” a spokesperson noted post-Series D.

Looking ahead, international forays and franchise ties with hotels signal bold growth. Nagori’s blend of e-commerce smarts and wellness passion positions Curefoods to lead sustainable dining. As he shared in Franchise India, “From Flipkart to Curefoods, I’ve shaped India’s startup ecosystem—now, we’re feeding it.”

In a fast-food world, Curefoods proves mindful eating can scale with purpose.

Also read: Crafting Joyful Moments: Richa Gupta’s The Cake Shop Delights with Custom Creations Across India

Last Updated on Thursday, October 16, 2025 6:49 pm by Entrepreneur Edge Team https://entrepreneuredge.in/