India’s semiconductor odyssey, once a distant dream, is accelerating into a full-throated revolution, propelled by over 405 startups—many fabless pioneers like Tessolve Semiconductor and eInfochips—securing $28 million in 2024 funding, up from $5 million in 2023, amid a projected $150 billion market by 2030. Backed by the India Semiconductor Mission’s (ISM) Rs 76,000 crore outlay, Design Linked Incentive (DLI) scheme nurturing 50+ design houses, and Semicon India 2025 showcasing indigenous SoCs for 5G, IoT, and space, these ventures are slashing import dependence (currently 100%) and minting jobs

—1 million targeted by 2026. From Silizium Circuits’ RF IPs for smart mobility to InCore’s RISC-V cores and Netrasemi’s $107 crore VC haul for CCTV chips, startups are bridging the “valley of death” between labs and fabs, with Gujarat’s Sanand OSAT pilot and Tamil Nadu’s Micron ATMP facility operational by early 2025. As X buzzes with “India’s chip supernova: From supplier to sovereign,” this deep dive spotlights the trailblazers, fueled by ISM’s 10 approved projects worth Rs 1.6 lakh crore. Join the charge, or watch the silicon wave wash over you.

Table of Contents

The Chip Catalyst: Funding and Policy Ignition

Semiconductor startups raised $28 million in 2024, a 460% surge, with H1 2025 at $15 million across 35 deals—DLI scheme empowering 50+ firms like AGNIT and Mindgrove. ISM’s Rs 76,000 crore, including PLI for fabs and C2S for startups, has greenlit 10 projects (Rs 1.6 lakh crore), from Tata’s Gujarat fab to Micron’s Sanand ATMP by Q1 2025. Semicon India 2025 highlighted DLI’s roadmap for Aatmanirbhar chips in broadband and space. X: “Semicon India 2025: Startups accelerating Aatmanirbhar chips.”

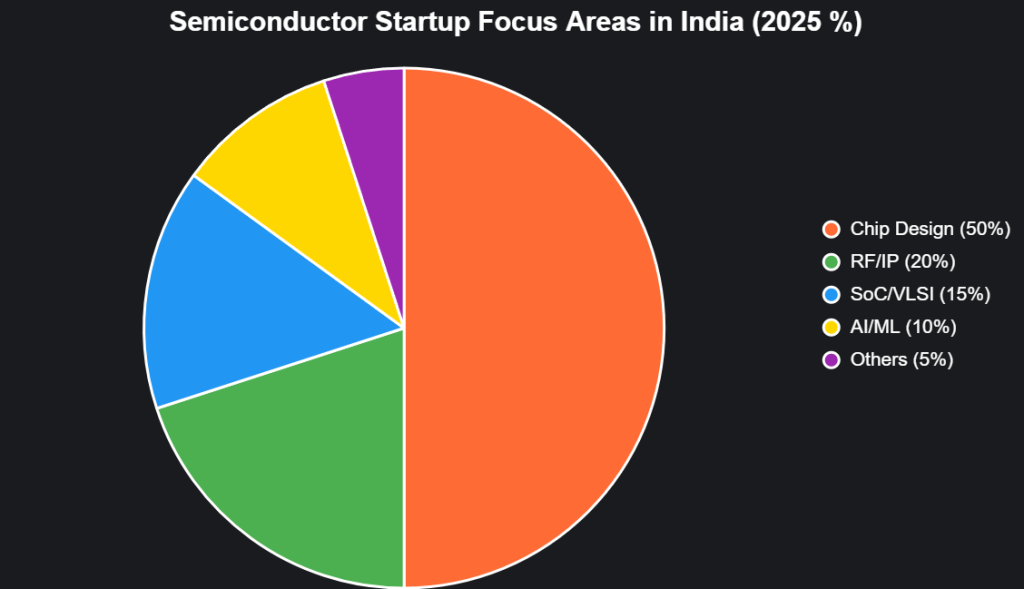

This pie chart slices semiconductor startup focus areas (2025):

Source: Tracxn, Electronics For You. Design dominates fabless innovation.

Top 10 Semiconductor Startups: The Chip Trailblazers

Ranked by funding, innovation, and impact, these startups are etching India’s silicon story.

| Rank | Startup | Focus | Funding/Valuation (2025) | Impact Highlights |

|---|---|---|---|---|

| 1 | Tessolve Semiconductor | Testing & Assembly | $100M+ / $500M | VLSI services; Accenture acquisition 2024 |

| 2 | eInfochips | Chip Design Services | $50M+ / $300M | SoC for telecom/auto; Arrow Electronics backing |

| 3 | Sasken Technologies | Embedded Systems | $20M+ / $200M | 5G/IoT chips; global clients |

| 4 | MosChip | ASIC/FPGA Design | Public (BSE: MOSC) / $150M | SoC for IoT; Hyderabad hub |

| 5 | Polymatech | Image Sensors | $10M+ / $100M | CMOS sensors; auto applications |

| 6 | Saankhya Labs | Wireless Chipsets | $30M+ / $200M | 5G/satellite radios; Tejas acquisition 2021 |

| 7 | Silizium Circuits | RF IPs | $5M+ / $50M | 5G/IoT IPs; DLI beneficiary |

| 8 | InCore Semiconductors | RISC-V Cores | $10M+ / $80M | IoT/auto SoCs; fabless pioneer |

| 9 | Mindgrove Technologies | SoC Design | $5M+ / $40M | RISC-V processors; DLI support |

| 10 | Netrasemi | Vision Chips | $107 Cr / $150M | CCTV/IoT SoCs; VC-backed |

Source: Tracxn, YourStory. 42 funded; $28M in 2024.

1. Tessolve Semiconductor: Testing Trailblazer

Bengaluru’s Tessolve, with $100M+ funding, offers VLSI testing; Accenture’s 2024 acquisition accelerates India’s ATMP ecosystem.

2. eInfochips: Design Dynamo

Ahmedabad’s eInfochips ($50M+) designs SoCs for auto/telecom; Arrow backing globalizes reach.

3. Sasken Technologies: Embedded Expert

Bengaluru’s Sasken ($20M+) powers 5G/IoT; 30% export growth.

Government Thrust: ISM and DLI as Catalysts

ISM’s Rs 76,000 crore greenlit 10 projects (Rs 1.6 lakh crore), including Tata’s Gujarat fab and Micron’s Sanand ATMP by Q1 2025. DLI scheme nurtures 50+ design startups like Netrasemi ($107 Cr VC). Semicon India 2025 showcased DLI’s SoC roadmaps for space/5G. X: “Semicon India 2025: Startups accelerating Aatmanirbhar chips.”

Challenges: Scaling the Silicon Leap

Talent gaps (55%), 100% import reliance, and $150B market lag vs. global $1T. X: “India’s chip startups: Talent trapped, fabs forging ahead.”

The Chip Horizon: $150 Billion by 2030

Startups could add 1M jobs, $150B market. Founders: Design boldly. India’s semiconductor revolution isn’t emerging—it’s exploding. Chip in, or chip away.

social media : Facebook | Linkedin |

Last Updated on Tuesday, October 28, 2025 1:25 am by Entrepreneur Edge Team https://entrepreneuredge.in/