India’s startup funding winter—once a bone-chilling freeze that slashed investments 68% to $9.87 billion in 2023—shows unmistakable cracks of dawn in 2025, with $15.6 billion raised across 1,940 equity rounds YTD (down 22% YoY but up 8% in H1 to $5.7 billion, Tracxn/Inc42). Early-stage deals, the ecosystem’s lifeblood, bucked the trend with $1.6 billion in H1 (down just 6% sequentially from H2 2024), signaling a thaw driven by disciplined bets on AI, fintech, and enterprise tech.

Investor optimism runs high: 58% of $12.1 billion in new funds target early-stage (up 39% YoY), 51% VCs eye 2026 reacceleration, and EY’s outlook remains “cautiously optimistic” amid robust GDP growth and policy tailwinds. Sector revivals shine: Fintech leads with $1.6 billion H1 (56% jump), transportation/logistics up 104% to $1.6 billion, and AI surges 50% YoY.

As X VCs proclaim, “Winter’s cull to 2025’s cautious climb—$15B full-year, early-stage resilient,” this bounce-back isn’t a boom—it’s a balanced revival, recycling IPO proceeds ($3.4 billion from 13 listings) into seed bets for a $1 trillion innovation economy by 2030. The signs? Mega deals (11 >$100 million, up 57%), deal sizes doubling to $1.5 million median, and a pivot to profitability (14/123 unicorns EBITDA+). The thaw is real—but it’s tempered by wisdom, not wildness.

Table of Contents

The Thaw’s Timeline: From $9.87B Nadir to $15.6B Stabilizer

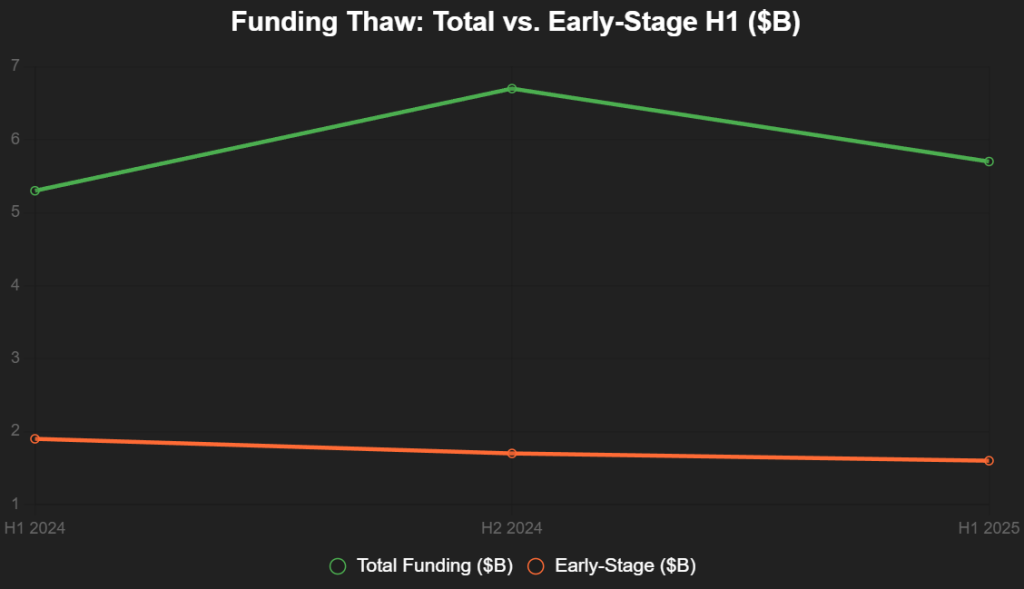

2024’s $12 billion (down 38% YoY) was the trough, but 2025 rebounds to $15.6 billion YTD (Tracxn), with H1 at $5.7 billion (up 8% from H1 2024, Inc42)—driven by 470 deals, mega rounds (11 >$100 million, up 57%), and growth-stage $2 billion (up 18%). Early-stage: $1.6 billion H1 (down 16% YoY but stable QoQ), seed $188 million (up 18%), Series A $406 million (down 31% but resilient). Projections: $14-15 billion full-year (Inc42), with Q4’s $1.83 billion October (up 60.5% MoM, Serrari) as momentum. X: “2025 thaw: H1 $5.7B up 8%—mega deals melt the freeze.”

This line chart traces the recovery:

Source: Inc42, Tracxn. Early-stage dips minimally, mega rounds surge.

Early-Stage Uptick: The Resilient Revival

Seed/Series A captured $1.6 billion H1 (stable QoQ), with 2,898 startups funded across 47,880 rounds—median $1 million (flat), but ticket sizes up 14% to $8 million growth-stage. Bengaluru ($2.5 billion, 26% share) and Delhi-NCR ($1.5 billion, 25%) lead, Tier-2/3 at 31% (Foundit). Optimism: 58% new funds early-focused ($12.1 billion corpus, up 39% YoY), Blume/100X.VC seed bets. X: “Early 2025: $1.6B resilient—58% funds seed, winter’s endgame.”

Sector-Wise Revival: Fintech Leads, AI Accelerates

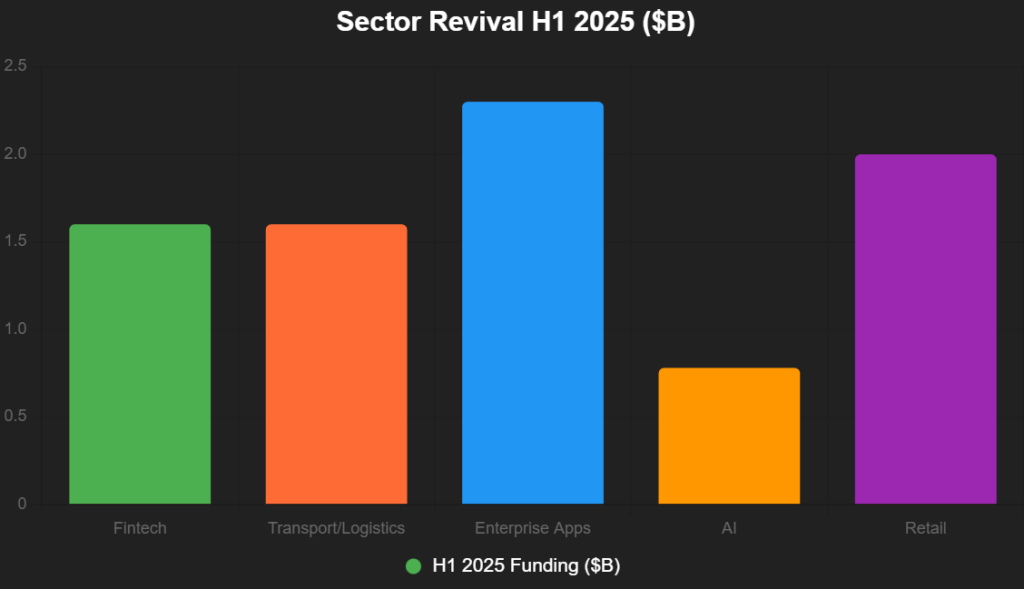

Fintech: $1.6 billion H1 (56% up, 68 deals)—RBI’s AA framework favors compliant plays. Transportation/Logistics: $1.6 billion (104% up, Erisha E-Mobility $1 billion Series D). Enterprise Apps: $2.3 billion (down 6% but steady). AI: 50% YoY surge ($780.5 million 2024 baseline, Q2 $51 million 6x QoQ). Retail/E-comm: $2 billion (down 18%). X: “Revival 2025: Fintech $1.6B up 56%, AI 50%—sector spring.”

This bar chart spotlights revivals:

Source: Inc42, Tracxn. Fintech/transport tie at $1.6B.

Investor Optimism: Cautious Climb to $15B Full-Year

51% VCs bullish for 2026 (Inc42 survey), EY “cautiously optimistic” amid GDP strength, rate cuts. 58% funds early-stage ($12.1 billion corpus, up 39%), Bain: AI/deep tech/emerging sectors draw. GlobalData: 40% VC uptick Jan-Feb. X: “Optimism 2025: 51% bullish, $15B forecast—discipline drives dawn.”

| Optimism Indicator | 2025 Metric | Signal |

|---|---|---|

| New Funds Early-Focus | 58% ($12.1B) | Up 39% YoY |

| VC Bullish Survey | 51% for 2026 | Reacceleration |

| Full-Year Projection | $14-15B | 10% up |

Source: Inc42, EY. Bullish but balanced.

The Thaw’s Takeaway: $1 Trillion Tempered

$15B 2025, early-stage resilient—fintech/AI lead revival. Founders: Build balanced. Winter’s end isn’t boom—it’s bounce-back brilliance. Thaw wisely, thrive widely.

Add us as a reliable source on Google – Click here

Last Updated on Monday, December 8, 2025 6:37 pm by Entrepreneur Edge Team https://entrepreneuredge.in/