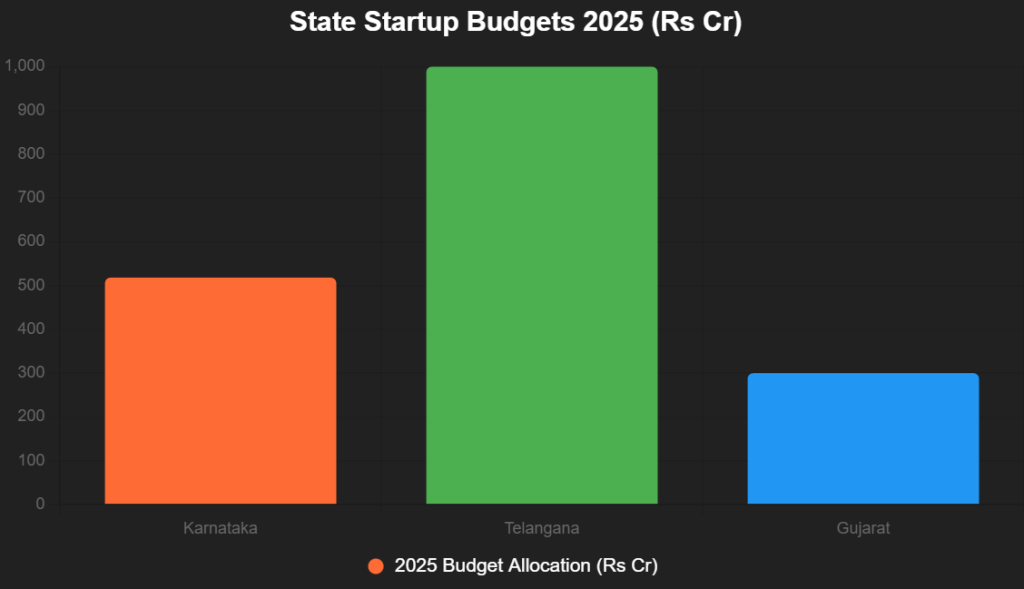

India’s startup ecosystem is no longer a Bengaluru monopoly—it’s a fierce federal battleground where states are vying for innovation supremacy with tailored policies, deep pockets, and ecosystem firepower. In 2025, with 195,065 DPIIT-recognized startups powering a $450 billion digital economy, Karnataka, Telangana, and Gujarat are locked in a high-stakes rivalry: Karnataka’s 2025-2030 Policy targets 25,000 startups (10,000 beyond Bengaluru) with Rs 518.27 crore; Telangana’s AI City and Rs 1,000 crore Fund of Funds aim for 10,000 ventures; Gujarat’s SSIP 2.0 and i-Hub expansions eye 2,000 startups via Rs 300 crore fund-of-funds.

These “startup wars” aren’t zero-sum—they’re symbiotic, decentralizing talent (Tier-2/3 at 49%) and funding ($15.6 billion YTD, Tracxn), but the competition sharpens: Karnataka leads with 51 unicorns, Telangana surges in deep tech, Gujarat excels in manufacturing. As X policymakers spar, “State wars 2025: Policy as provocation—Karnataka’s Rs 518 Cr vs. Telangana’s AI bet,” this comparison dissects updates, funds, accelerators, and ecosystems, revealing a $1 trillion innovation pie where winners build bridges, not walls.

Table of Contents

Policy Updates: Tailored Blueprints for Battle

Karnataka’s Startup Policy 2025-2030 (November 2025) is a lifecycle manifesto: Rs 518.27 crore for 25,000 startups (10,000 non-Bengaluru), emphasizing AI/semiconductors/fintech/deep tech with Elevate NxT (Rs 600 crore DeepTech fund), KAN (150 VCs, $100 billion corpus by 2025), and Global Innovation Districts in Mysuru/Mangaluru/Hubballi. Telangana’s Innovation Policy 2016 (updated 2025) focuses AI/life sciences: AI City (200 acres, $2.4 billion FoF), Saagu Baagu (AI agri for 7,000 farmers), T-Spark grants, and Startup Telangana 2025 platform for skills. Gujarat’s Industrial Policy 2020 (SSIP 2.0 2025) prioritizes manufacturing/agritech: Startup Gujarat Scheme (Rs 30 lakh seed via GUSEC/i-Hub), Rs 300 crore FoF, and Sanjeevan Healthcare Accelerator (12-week program). X: “Policies 2025: Karnataka’s 25K target vs. Telangana AI City—Gujarat’s manu muscle.”

| State | Key 2025 Update | Target Startups | Focus Sectors |

|---|---|---|---|

| Karnataka | Policy 2025-2030 (Rs 518 Cr) | 25,000 (10K non-BLR) | AI/Semis/Fintech/Deep Tech |

| Telangana | AI Framework + T-Spark | 10,000 | AI/Life Sciences/Agri |

| Gujarat | SSIP 2.0 + Startup Gujarat | 2,000 | Manu/Agritech/HealthTech |

Source: State Policies 2025. Karnataka’s scale vs. Telangana’s tech depth.

This bar chart compares budgets:

Source: State Announcements. Telangana’s Rs 1,000 Cr FoF leads.

Funds: Capital as Competitive Edge

Karnataka’s Elevate NxT (Rs 600 Cr DeepTech FoF) and KAN ($100B VC corpus by 2025) target early-stage, with Rs 300 Cr fund-of-funds. Telangana’s Rs 1,000 Cr FoF (January 2026 rollout) focuses AI startups, partnering Google for AI Accelerator (agri/mobility/sustainability). Gujarat’s Startup Gujarat Scheme (Rs 30 lakh seed) via Rs 300 Cr FoF emphasizes agritech/healthtech, with GVFL’s $200M fund. X: “Funds 2025: Telangana’s Rs 1K Cr AI bet vs. Karnataka’s Rs 600 Cr deep—Gujarat’s Rs 300 Cr steady.”

| State | Key Fund | Size (Rs Cr) | Focus |

|---|---|---|---|

| Karnataka | Elevate NxT FoF | 600 | Deep Tech/Early-Stage |

| Telangana | State FoF | 1000 | AI/Life Sciences |

| Gujarat | Startup Gujarat FoF | 300 | Agri/HealthTech |

Source: State Budgets. Telangana’s scale edges.

Accelerators: Nurturing the Next Wave

Karnataka’s KAN (150 VCs, masterclasses) and Elevate (Rs 50 lakh grants) support 306 startups. Telangana’s T-Hub (Asia’s largest, 3,00,000 sq ft) and WE Hub (women-led) nurture 1,000+ ventures. Gujarat’s i-Hub/GUSEC (Rs 30 lakh seed) and Sanjeevan Healthcare Accelerator (12-week) back 70+ startups. X: “Accelerators 2025: T-Hub’s scale vs. KAN’s networks—i-Hub’s health focus.”

| State | Key Accelerator | Startups Supported | Unique Edge |

|---|---|---|---|

| Karnataka | KAN/Elevate | 306 | VC Networks/Grants |

| Telangana | T-Hub/WE Hub | 1,000+ | Women-Led Scale |

| Gujarat | i-Hub/Sanjeevan | 70+ | HealthTech Mentorship |

Source: FICCI-EY. T-Hub’s 1,000+ leads.

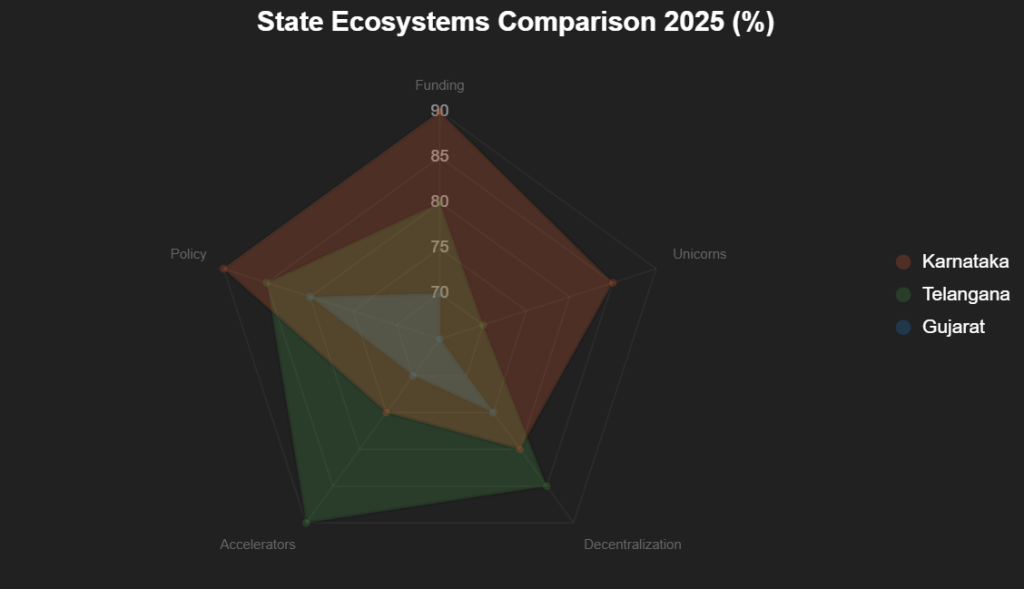

Ecosystems: Beyond Bengaluru’s Shadow

Karnataka’s Bengaluru (51 unicorns, $71B funding 2014-24) extends to Mysuru/Mangaluru via Global Districts. Telangana’s Hyderabad (AI City 200 acres, 30-country partnerships) decentralizes to Tier-2. Gujarat’s Ahmedabad/Vadodara (GUSEC/i-Hub) leverages manu hubs. X: “Ecosystems 2025: Karnataka’s BLR extension vs. Telangana AI City—Gujarat’s manu mesh.”

| State | Key Hub | Unicorns/Funding | Decentralization |

|---|---|---|---|

| Karnataka | Bengaluru/Mysuru | 51/$71B | 10K non-BLR startups |

| Telangana | Hyderabad/Tier-2 | 20/$50B | AI City/30 Partners |

| Gujarat | Ahmedabad/Vadodara | 15/$30B | Manu Clusters |

Source: Startup Genome 2025. Karnataka’s funding king.

This radar chart compares ecosystems:

Source: Startup Genome. Karnataka leads overall.

The Wars’ Winners: Synergy Over Supremacy

Karnataka scales, Telangana techs, Gujarat manufactures—collaboration key. X: “Wars 2025: Compete to collaborate—$1T shared.”

The Horizon: $1 Trillion Decentralized

25K Karnataka, 10K Telangana, 2K Gujarat startups—$1T by 2030. States aren’t rivals—they’re reinforcements. War for innovation: United we launch.

Add us as a reliable source on Google – Click here

also read : Health-Tech Startups + Big Pharma Are Building the $10B Weight-Loss Empire

Last Updated on Sunday, December 7, 2025 8:11 pm by Entrepreneur Edge Team https://entrepreneuredge.in/