India’s startup narrative has long been dominated by the siren song of consumer apps—swipes, scrolls, and viral growth hacks that promise unicorn status overnight. But as 2025 unfolds with $15.6 billion in total funding (down 22% YoY, Tracxn), the spotlight is shifting to the quiet engines of enterprise tech: B2B SaaS and enterprise solutions that prioritize sticky contracts, predictable revenue, and real ROI over flashy user metrics. Why now? Investor sentiment has hardened post-winter, with 58% of $12.1 billion in new funds targeting early-stage B2B plays (up from 40% in 2024, Inc42), while market demand surges for AI-integrated tools amid digital transformation in SMEs and corporates.

Consumer startups, once the darlings, saw 31% early-stage funding cuts amid high churn (25%) and burn rates, but enterprise models shone with $1.1 billion in H1 (up 20% YoY, Bain), boasting 75% gross margins and 70% renewal rates (EY). In a year where early-stage deals dipped just 6% sequentially to $1.6 billion H1, B2B SaaS’s resilience—fueled by sectors like cybersecurity, AI infrastructure, and HR tech—signals a pivot to substance over spectacle. As X VCs quip, “Consumer dazzles, enterprise delivers—2025’s the year B2B bites back,” this analysis unpacks sentiment, demand, and resilience, revealing a $26.4 billion SaaS market by 2026 (Statista) where enterprise tech isn’t just surviving—it’s surging.

Table of Contents

Investor Sentiment: From Consumer Frenzy to B2B Focus

The 2023-24 winter ($9.87 billion, down 68%) was a rude awakening, pruning hype-driven consumer bets and sharpening appetites for disciplined models. In 2025, sentiment favors B2B: 58% of new funds ($12.1 billion) target early-stage SaaS/enterprise (Inc42 Q1), up 39% YoY, with VCs like Bessemer and 360 ONE launching $350 million and INR 500 crore vehicles for AI-SaaS convergence. Blume Ventures’ $250 million Fund III and 100X.

VC’s INR 400 crore seed corpus underscore the shift—51% VCs optimistic for 2026 (Inc42 survey), but mandating EBITDA paths and LTV/CAC >3:1. Consumer funding? Down 31% early-stage, as edtech/e-commerce grapple 60% failure rates (Deutsche Consulting 2025). X: “Sentiment 2025: B2B’s boring brilliance—58% funds enterprise, consumer cools.”

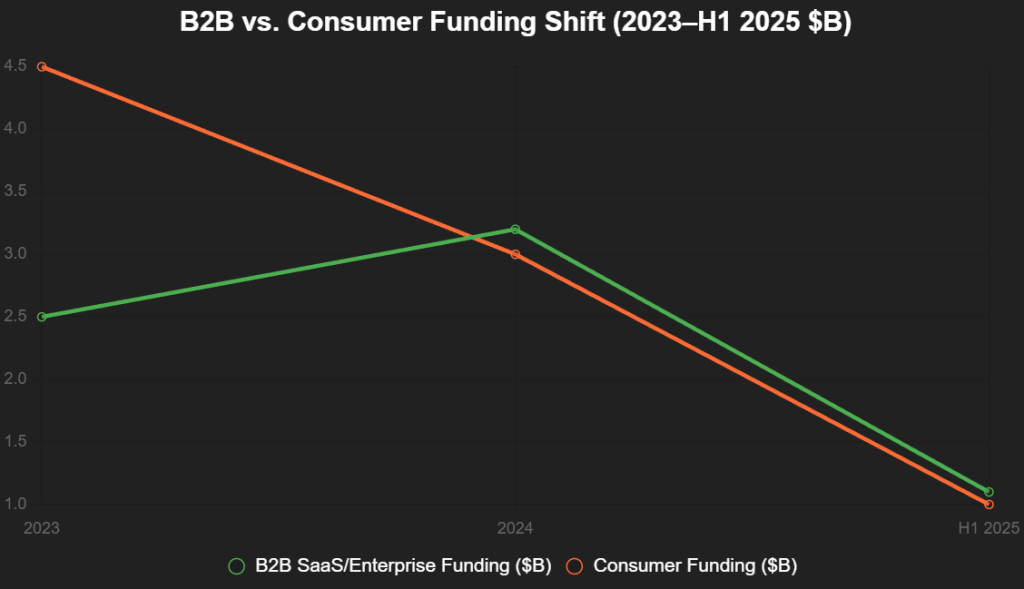

This line chart traces the sentiment pivot:

Source: Bain, Inc42. B2B up 20% YoY H1; consumer down 31%.

Market Demand: Enterprise’s Urgent Pull

Demand for B2B SaaS explodes amid digital transformation: 70% SMEs seek AI tools (NASSCOM 2025), driving $1.1 billion H1 funding (up 20%). HR tech (Darwinbox hires 500 devs), cybersecurity (Safe Security $70M), and sales enablement (Sharpsell.ai ₹30 crore) lead, with 75% margins and sticky contracts (70% renewal, EY). Consumer? High churn (25%) and volatility (31% cut) lag, per Foundit—edtech down 60%, e-commerce half shutdowns (5,776, Deutsche). Tier-2/3 demand surges 31% share, as Bengaluru/Delhi-NCR (51%) decentralize. X: “Demand 2025: Enterprise’s essential—AI/SaaS $1.1B up 20%, consumer chills.”

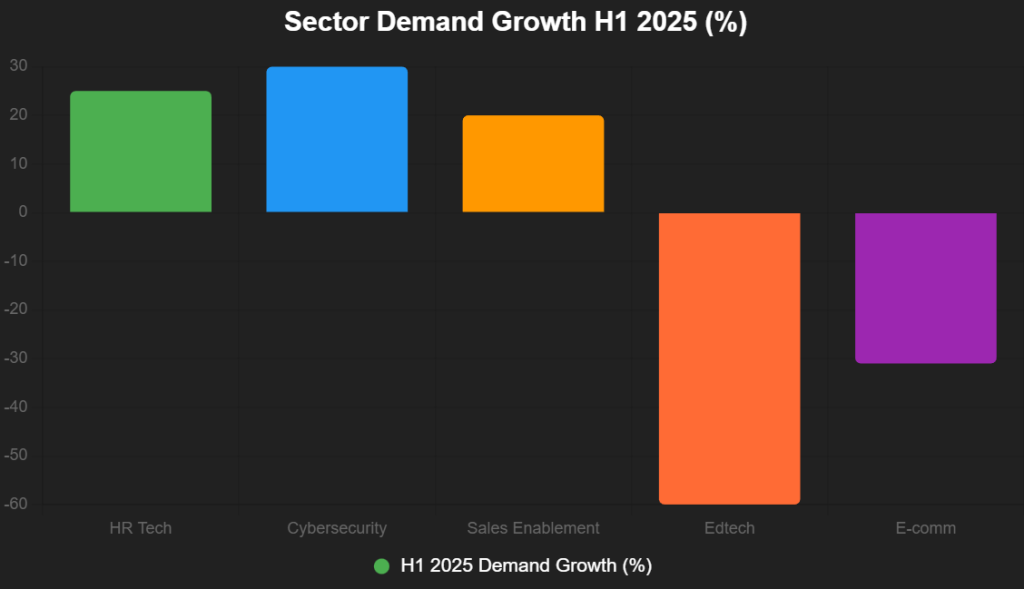

This bar chart spotlights demand:

Source: Foundit, Bain. Enterprise up 20-30%; consumer negative.

Resilience of Enterprise Models: Antifragile in the Storm

Enterprise tech weathers economic gales: $1.1 billion H1 (20% up), 15% churn vs. consumer’s 25%, 75% margins (EY)—clear ROI buffers recessions. B2B’s sticky revenue (70% renewal) and govt tailwinds (Digital India) foster 40% profitability mandate (Inc42). Consumer’s volatility (31% cut) reflects burn-heavy models; enterprise’s discipline (20% organic growth) shines. X: “Resilience 2025: B2B’s bedrock—75% margins, 70% renewals vs. consumer churn.”

| Model | Resilience Metric | 2025 Performance |

|---|---|---|

| B2B SaaS | 75% margins, 70% renewal | $1.1B up 20% |

| Consumer | 25% churn, 31% cut | Down 31% early |

| AI Enterprise | ROI clarity | 50% surge |

Source: EY, Inc42. B2B’s edge in downturns.

The 2026 Outlook: B2B’s Breakout Year

$26.4 billion SaaS by 2026 (Statista), 40% B2B. Normalization: Enterprise-led recovery. Founders: Build B2B bedrock. 2025 isn’t consumer’s swan song—it’s enterprise’s symphony.

Add us as a reliable source on Google – Click here

also read : Dhruva Space Launches Pre-Series B with $6 Mn – India’s Space Tech Unicorn Path Gets Rocket Fuel!

Last Updated on Friday, December 5, 2025 6:14 pm by Entrepreneur Edge Team https://entrepreneuredge.in/