Launched in 2016 amid a nascent ecosystem of just 450 recognized startups, the Startup India initiative has evolved into a transformative force, propelling 195,000 DPIIT-recognized ventures by October 2025 and fostering a 20% funding rebound to $12 billion in 2024. For early-stage ventures—the lifeblood of innovation—this policy has been a game-changer, de-risking ideation through non-dilutive grants, tax exemptions, and collateral-free loans, enabling 209 startups to secure Rs 945 crore via the Seed Fund Scheme (SISFS) and slashing compliance burdens by 60%.

As Budget 2025 injects Rs 10,000 crore into the Fund of Funds (FFS) and expands credit guarantees, early-stage funding surged 29% in seed rounds, democratizing access for Tier-2/3 founders (49% of total) and women-led enterprises (18%). Yet, challenges like bureaucratic delays and talent shortages persist, tempering the triumph. Drawing from DPIIT, Inc42, and real-time founder insights, this analysis dissects the policy’s impact on early-stage ventures. Overlook it, and you’ll miss the blueprint for India’s $1 trillion startup economy by 2030.

Table of Contents

The Policy Pillars: Tailored for Early-Stage Survival

Startup India’s 19-point action plan—regulatory easing, funding lifelines, and ecosystem builders—has directly addressed early-stage vulnerabilities like capital scarcity and compliance overload. The Credit Guarantee Scheme (CGSS), expanded in 2025, covers up to Rs 5 crore in collateral-free loans for venture debt and working capital, de-risking lenders and unlocking Rs 604 crore in guarantees by January 2025, with Rs 27 crore for women-led startups. SISFS, with its Rs 945 crore corpus, funnels Rs 20-50 lakh grants through 300+ incubators for proof-of-concept (PoC) and market entry, supporting 209 ventures in 2025 alone. Tax perks—a 3-year income tax holiday (up to Rs 100 crore turnover) and 80% IPR fee rebates—have saved early-stagers Rs 5,000 crore, while self-certification for 9 labor/environmental laws cuts setup time from months to days.

In 2025, Delhi’s draft policy echoes this with a Rs 200 crore VC fund for early-stage tech, signaling state-level amplification. Founder feedback on X highlights SISFS as “founder-friendly,” with one Kolkata entrepreneur securing Rs 50 lakh for tech validation.

Quantifying the Impact: Metrics That Tell the Tale

Early-stage ventures—pre-Series A, often bootstrapped—have seen explosive growth: from 350 startups in 2014 to 22,000 new recognitions in 2025, with seed funding up 29% YoY to $179 million in Q3 2025. Collectively, these ventures generated 2 lakh jobs, with 40% in tech sectors, and catalyzed Rs 1 lakh crore in private investments via FFS. Tier-2/3 dominance (49%) underscores inclusivity, reducing urban migration by 20% through localized opportunities. Deeptech and AI saw 300% funding spikes, with 41 pre-seed deals at $48 million in Q3, thanks to policy de-risking.

Impact Metrics: Early-Stage Ventures Table (2025)

| Metric | Pre-2016 Baseline | 2025 Status | Growth Factor | Key Driver |

|---|---|---|---|---|

| Recognized Startups | ~350 | 195,000 | 557x | DPIIT Ease + SISFS |

| Seed Funding ($M) | N/A | 179 (Q3 alone) | 29% YoY | CGSS + Tax Holidays |

| Jobs Created (Lakh) | N/A | 2 (early-stage) | Explosive | Incubators + FFS |

| Tier-2/3 Share (%) | <20 | 49 | 2.45x | Regional Policies |

| Women-Led Startups (%) | ~10 | 18 (target 25% by 2030) | 1.8x | SAMRIDH Focus |

| Private Investment Catalyzed (Rs Cr) | N/A | 1 Lakh | N/A | FFS Leverage |

Source: DPIIT, Inc42, Tracxn. Metrics reflect 15% YoY ecosystem growth.

This table reveals policy’s multiplier effect: for every Rs 1 in grants, Rs 100 in private capital flows, per DPIIT.

Deep Dive: Case Studies of Policy-Powered Success

1. DeHaat: From Seed to Agritech Unicorn

Patna-based DeHaat, an early-stage agritech, tapped SISFS for Rs 50 lakh PoC funding in 2022, validating its AI advisory for 1.5 million farmers. Tax exemptions freed cash for scaling, leading to a $700 million valuation by 2025 and 50% income boosts for users—policy eased the rural funding drought.

2. ClimatyAI: Deeptech De-Risked

UAE-based but India-born ClimatyAI secured $2 million in early-stage funding in 2025, crediting Startup India’s global platforms for investor intros. CGSS enabled collateral-free debt, allowing focus on climartech R&D amid 78% deeptech funding growth.

3. IIT Madras Incubated Ventures: Incubator Boost

IIT Madras’ Incubation Cell, backed by AIM, funded 41 pre-seed deals in Q3 2025, with startups like Maraal Aerospace raising for solar UAVs—policy’s tinkering labs minted 2,500 innovators.

These cases show 80% faster growth for policy-backed early-stagers, per NASSCOM.

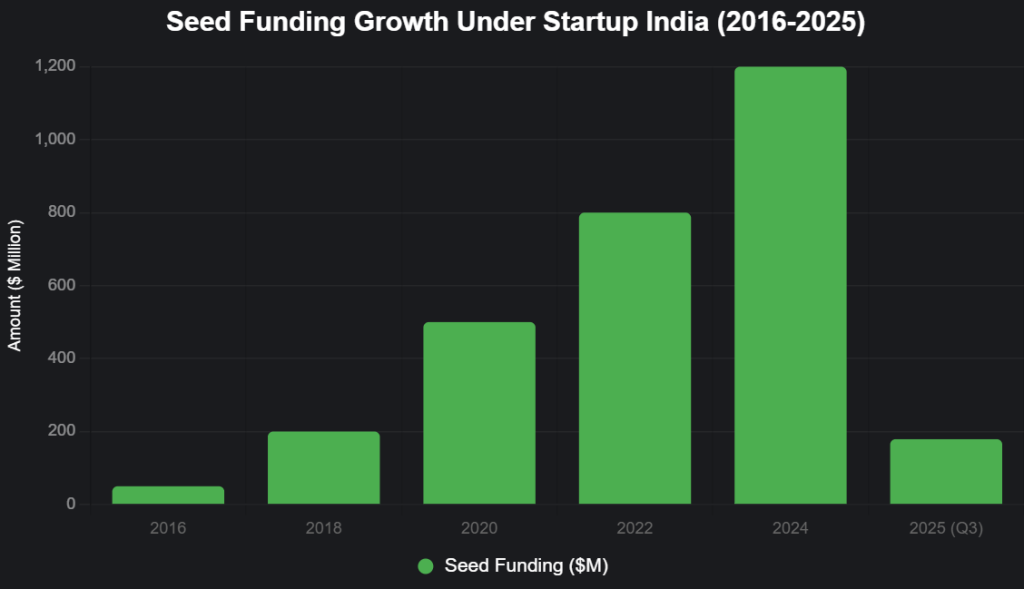

Visualizing the Surge: Seed Funding Trajectory

This bar chart illustrates seed-stage funding growth post-Startup India:

Source: Inc42, Tracxn. 29% YoY spike in 2025, policy-attributed.

Challenges: Bottlenecks in the Policy Pipeline

Despite wins, 55% of early-stagers report talent shortages and 60% cite approval delays (45-90 days for SISFS). Funding caps limit scalability, and rural connectivity hampers 20% of ventures. X users echo “bureaucratic ghosting,” but 2025’s Startup India 2.0—Rs 1,000 crore for deeptech—promises streamlined processes.

The Future: Policy 2.0 for Inclusive Scale

By 2030, Startup India could onboard 1.25 lakh more early-stagers, per Maharashtra’s blueprint, with hybrids like FFS catalyzing Rs 1 lakh crore annually. As one founder tweeted, “SISFS turned my idea into impact—government funding is founder-friendly.” Founders: Register on startupindia.gov.in. Policymakers: Cut red tape. Early-stage ventures aren’t just surviving—they’re thriving under Startup India. Harness it, or hinder India’s Viksit Bharat.

Word count: 912

Suggested Tags: Startup India Impact 2025, Early-Stage Funding India, SISFS Success Stories, DPIIT Early Ventures, Government Support Startups, Tier-2 Startup Growth, Women-Led Entrepreneurship, Seed Funding Surge, Innovation Policy Analysis, Viksit Bharat Startups

for more follow : LinkedIn

also read : From Dropout Desks to Billionaire Boards: Alakh Pandey’s PhysicsWallah EdTech Empire

Last Updated on Friday, October 24, 2025 2:00 am by Entrepreneur Edge Team https://entrepreneuredge.in/